All processes from a single source.

Comprehensive, professional tax representation for cross-border e-commerce – so you can concentrate on your business. From registration and pre-registration to communication with the authorities: we take care of everything.

Advantages at a glance

With us, you can fulfill your VAT obligations abroad reliably and with legal certainty. We take care of registration in the target countries, document all relevant documents and represent you in dealings with the tax authorities. This gives you full control with minimal administrative effort.

Selling internationally often means: new tax obligations, complex reporting formats and country-specific deadlines. We take care of the entire process for you.

From tax registration to advance VAT returns and annual declarations: we take care of all filings in the target country. Correctly, on time and audit-proof.

Whether queries, notifications or clarifications: We provide support with all communication with the tax authorities and benefit from long-standing relationships.

Set up for tax compliance

We take care of the complete VAT registration for your sales in markets such as the UK, Switzerland or Norway. We take care of all the necessary applications and documents, coordinate with the relevant authorities and ensure that you are registered correctly and on time as a taxable trader.

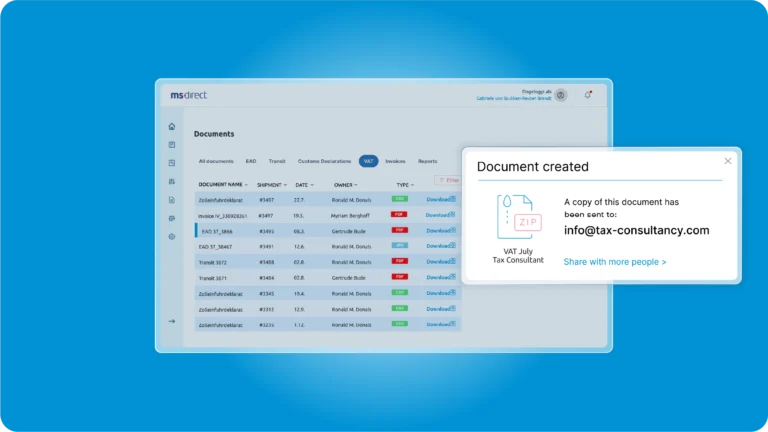

Timely notifications – fully automatic

We automatically generate all required VAT filings and submit them on time to the relevant authorities – including regular VAT returns and the annual VAT declaration. All data is complete and documented in a way that ensures audit compliance.

Secure storage of your tax data

All tax-relevant data and documents are prepared in accordance with the law, can be found and are archived in an audit-proof manner. This means you have access at all times, whether for internal purposes or in the event of a request from the authorities.

We support you!

You benefit from:

We provide fiscal representation and tax processing for the UK, Switzerland and Norway.

No, we take care of the entire tax registration process for you - including application, document preparation and communication with the relevant authorities in the destination country.

As a rule, returns are submitted quarterly (advance VAT return) and once a year (annual return). We automatically keep track of all deadlines for you and report on time.

We take care of all communication with the tax authorities. If your co-operation is required, we will get in touch with you.

The tax-relevant transaction data is provided automatically via our interface or via a secure upload. We take care of the preparation and further processing.

Yes, all documents and reports are archived digitally, in a structured and legally compliant manner. Audit-proof and retrievable at any time for audits or internal purposes.

More about our cross-border services

© 2026, MS Direct AG Part of MS Direct Group